A three month project launching a new venture in real estate looking to redefine the workplace that is currently in flux with the world changing around us. Embracing both in-person & remote work, the goal was to support tenants and occupiers to enable flexibility in real estate properties, systems, and business models while optimizing space needs and utilization.

I worked on this project with a large team, including client members. As a new venture team, we built a business from scratch in only twelve weeks and secured funding for the team to launch into phase two of product development and further go-to-market work.

This project was full of scrappy startup mentality, fun, and hard work to get to a successful end result. We began with open ended research, followed by value prop creation, solution testing, and business modeling.

SCALE

Launching a new venture, leveraging mothership capabilities, to disrupt the real-estate industry

HIT ME WITH THE HEADLINE:

This project included 200+ interviews, which is typical of our method. We quantify qualitative information to successfully create businesses. As the lead UX on my teams, I take responsibility for this quantification, including all sessions or creation of tools and methods that may be required to do so.

My role:

Lead researcher, co-founder

UNDERSTANDING THE CHALLENGE

This first time client was a Fortune 500 looking to expand their offerings, capitalizing on the uncertain nature of the world of remote work, and leveraging their current capabilities. We started with a 4 day kick off, helping the client to first define their interests, scope, and assumptive theories. Over the four days we simulated the steps we would take as a team to develop an initial business model and product vision.

This project, although, heavy on exploratory research also included building business case. For this team, we needed to prove to their mothership that we had identified a market pain deep enough to solve but that we would also leverage their differentiation while also being profitable enough in the long-term to justify a team spin-out funded by the mothership.

The starting point for this project was our 'North Star statement,' which was crafted during the kickoff using their industry expertise and assumptions.

The Team

Our project team for this project consisted of three members from my company, including myself, and four individuals from the client's team who were fully dedicated as the core new venture team. When working with a dedicated client team, the expectation is typically to educate them on our crafts—research and design theory, startup time management, and mentality—so they can independently lead the venture once they secure their first round of funding.

In this project, my role extended beyond teaching the clients; I also served as a mentor, guiding and training the other two members from my company who were new to the team. Therefore, a large part of my job in this project involved coaching.

The Potential Stakeholders:

The sessions in our kick-off lead to an initial, broad, starting point based off of team assumptions. We identified who might be best to engage with in the real-estate ecosystem based on where we hypothesize the most pain exists. We ended the kickoff with the following stakeholders to evaluate: Tenant Leaders responsible for managing RE and experience in office, retail & industrial industries.

We looked to refine to which stakeholder(s) would be our ‘entry to market’ as a consumer over the course of our project, and who would function as our buyers & influencers.

EXPLORATORY RESEARCH: PAINS

The first Phase of this project was to run exploratory research to understand how the ecosystem truly functions, where the strongest pains existed, and what would be in scope to tackle considering the client. We ran a total of 70 interviews – a combination of pain interviews and expert interviews.

With such a broad set of stakeholders to work with following kick-off, I started off our research by running expert interviews, sourcing a small amount of quality interviews with the team through linkedIn, community groups, and the client’s rolodex. The script for these interviews was crafted to address trends, strong areas of pain, structure of the ecosystem, and explore the responsibilities of our assumed target segments. The point was to build a foundational knowledge that would create a scaffolding for us to expand our research around.

After conducting a handful of expert interviews in the industrial, retail, and office RE spaces, I led the team through an evaluation of the data. Our goal was not only to identify key themes but also to discuss what would be in scope for the mothership. This conversation proved to be critical for us, revealing that many of our initial interests did not meet the scope criteria. However, I always like to remind my teams to evaluate but not exclude too early in the exploratory process. We kept this data in mind, but continued on to conduct pain interviews.

Following multiple rounds of interviews and thorough team data analysis—which included assessing the most intense and prevalent pain points, evaluating the mothership's advantage and scope, and analyzing market opportunities

—we focused our attention on tenant leaders and occupiers within the office space segment and a list of top pains to move forward with.

VALUE PROPOSITIONS

After identifying our target stakeholder and segment & their top pains, we moved to value prop creation. In this stage we ideated concepts, focusing on high level value and pains we hoped to solve.

To test these ideas, we used storyboards, running interviews that asked both qualitative and qualitative followups so we can evaluate the data in multiple ways, all while continuing to validate pain.

In the initial development of concept ideas, I like to ask my teams to ‘think big.’ I led a team brainstorm, using the top pains we identified as our anchors for ideas.The team generated countless ideas in our brainstorm, but by vote, we narrowed to the 6 we thought would best meet the needs of our target. We then developed these six into storyboards to test with our consumers.

SOLUTION TESTING

The transition to solution testing required, what I call, a mega-synthesis. We had multiple forms of data to evaluate – qualitative, quantitative, value prop feedback, and some solution testing that I had conducted in parallel with the previous phase.

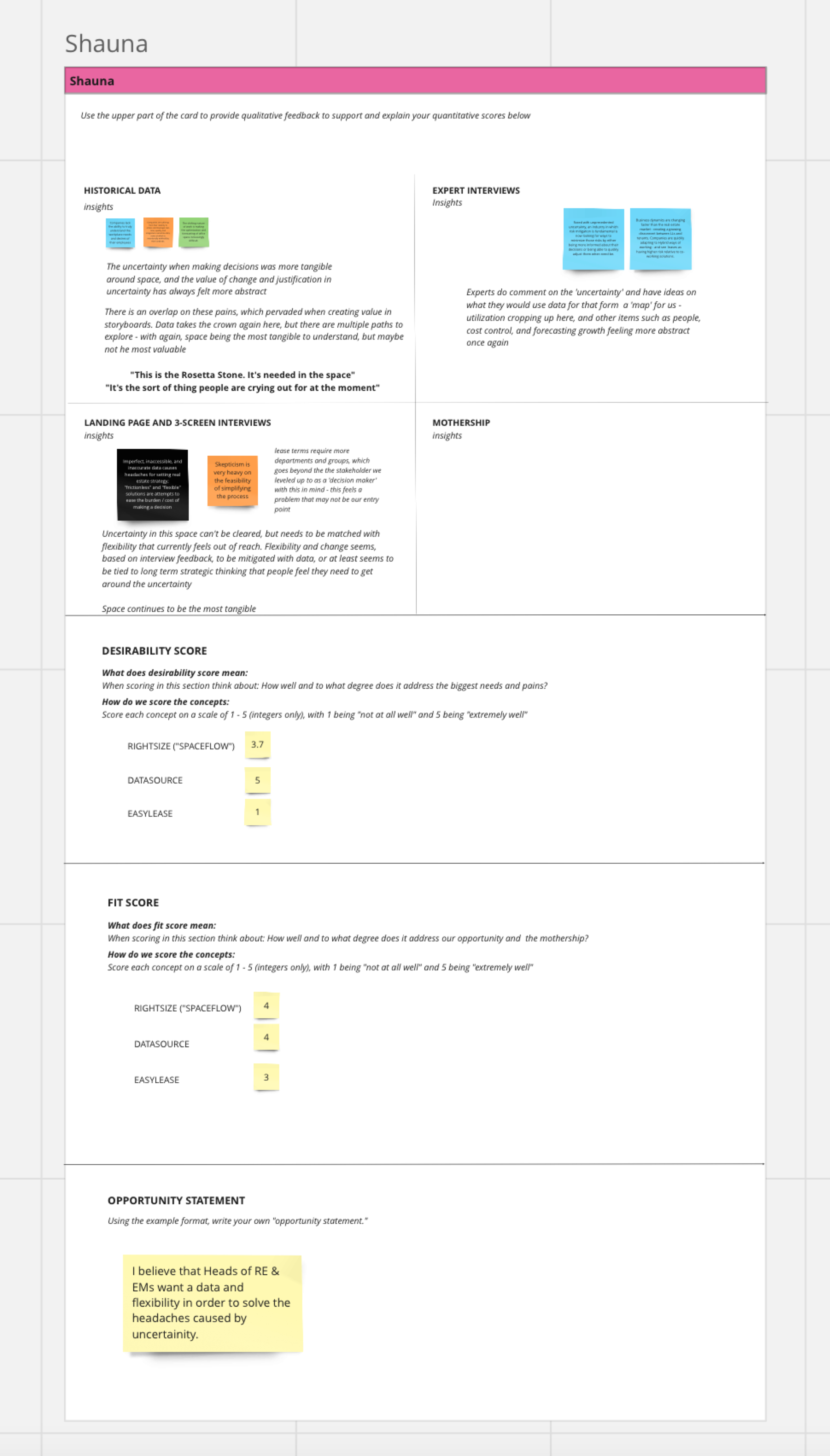

In order to do this effectively, I created a new data evaluation tool to help us review all previous phase outcomes. The tool was simple, using a score card system, but it helped us quantify which concept ideas would bring the most value to the consumer while also being the best fit for leveraging mothership advantages.

Take a look at a sample of the score card:

Once we had decided what concepts to move forward with, I worked with the dedicated designer that I was training to create low-fidelity prototypes. We extracted the value from multiple of the previous concepts based on the interview feedback, and took a first pass at creating our tests. The primary goal at this stage was to dig deeper into desirability, pinpointing the essential data the system needed to provide and identifying the features that would deliver the most value.

Although i’ve called this phase ‘solution testing’, our goal was to uncover the answers to key research questions to guide our product vision. We intentionally did not test for usability at this point, as it would be akin to putting icing on a cake that's not fully baked.

Take a look at our low-fidelity screens:

The team did a wonderful job selling their passion for the venture, engaging their board and sponsor during pitch, and bringing to life the vision of the product vision. We were able to secure their first round of funding from their mothership and the green light to proceed to the next round of product development.